Investment Strategies

Customized investment solutions designed to meet your goals, risk appetite, and timeline.

Proprietary Strategies

Our team provides investors with unparalleled expertise, strong experience, and exclusive access to investment opportunities in this new Ecosystem.

Real-time On-chain Verification

The on-chain verification workflow allows Apps to verify users' credentials inside a Smart Contract. Zero-Knowledge Proof cryptography enables.

Web3-native Risk Management

Our dedicated Web3 team is actively developing new insurance solutions, services, and capacity to meet emerging risks related to blockchain technology

Interactive Strategy Overview

Explore Interactive Strategies

Tailored To Your Goals.

Proprietary DeFi Investment Strategies

Yieldhaus Capital is an innovative Asset Manager focusing on high performing liquidity provisioning and investment strategies in the Decentralized Finance (DeFi) ecosystem.

Our team provides investors with unparalleled expertise, strong experience, and exclusive access to investment opportunities in this new ecosystem. Investors get exclusive access to high-return investment opportunities.

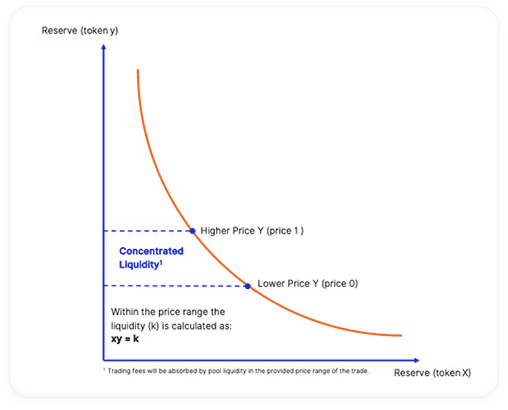

We leverage new & innovative concepts of effectively providing concentrated liquidity to Automated Market Makers (AMM) in the DeFi space in return for trading fees (yield).

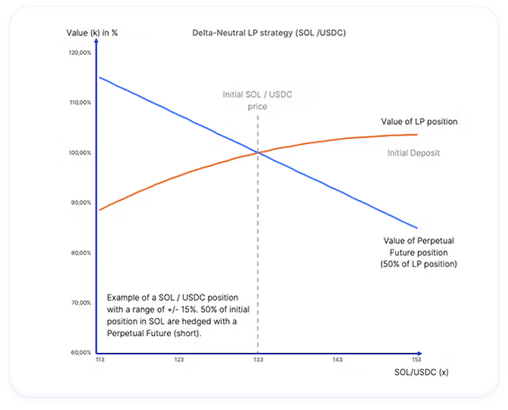

Market Neutral Liquidity Provisioning – Hedging the market risk

In order to maximize returns from generated yield and mitigate the risk of Impermanent Loss (IL), Yieldhaus Capital deploys mainly delta-neutral strategies aiming to reduce the price risk of volatile assets.

Investors will benefit from a steady return profile through generated yield whilst being protected from price risks of the underlying assets.

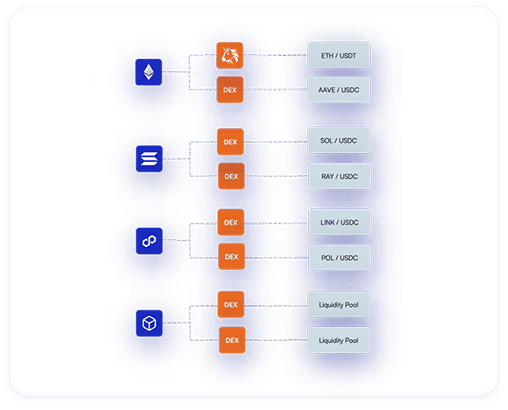

Diversification – Managing the counter-party risk

Liquidity is provided across multiple established Layer 1 and Layer 2 protocols and invested in a diversified Liquidity Pool (LP) portfolio of blue‑chip crypto currencies to spread risk.

All platforms and tokens selected by Yieldhaus Capital undergo rigorous audit and due diligence.

Yieldhaus Capital Investment Fund

If you are interested in investing in our regulated DeFi Concentrated Liquidity Fund, our sales team will be happy to provide further information.